Subscribe to our newsletter!

Stay updated with the latest news, special offers, and exclusive tips by signing up now.

en

Stay updated with the latest news, special offers, and exclusive tips by signing up now.

en

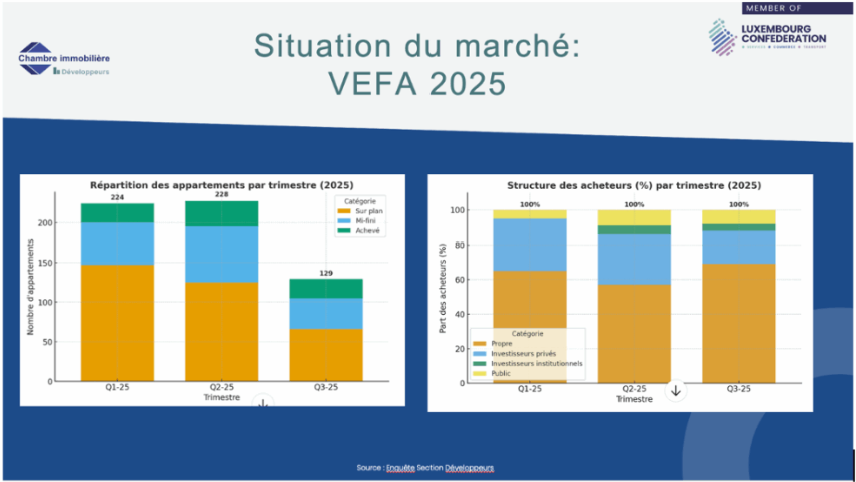

The VEFA market in 2025 is progressing in a mixed manner but remains solid. The first two quarters show stable and encouraging sales — 224 apartments sold in Q1 and 228 in Q2, mainly off-plan. This pace confirms that private buyers remain willing to purchase when projects are secure, well located, and fairly priced.

By contrast, the third quarter drops to 129 sales, reflecting a climate of uncertainty linked to financing conditions: interest rates around 3.5%, tighter requirements (20% equity contribution, Basel IV rules), and increasing difficulties in obtaining bridging loans.

The market continues to be dominated by owner-occupiers, while private investors are in clear decline and institutional investors remain marginal. Off-plan properties account for the majority of transactions, confirming that pure VEFA remains the driving force of the sector.

Overall, VEFA in 2025 is evolving in a cautious environment: demand is clearly present but highly dependent on access to credit, project reliability, and greater banking flexibility. Professionals are therefore calling for:

– reduced personal equity requirements,

– loan structures better aligned with the actual guarantees of projects,

– more flexible financing options starting from 20% pre-sales.

According to industry players, these adjustments could significantly revive residential investment.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.